Unlocking deeper cost and productivity benefits from UAVs

The near-term commercial benefits of drones are well known. In simple deployment scenarios, drones can improve productivity by reducing the cost of asset monitoring, which in turn enables more frequent inspection and better predictive maintenance.

Drones also offer a safety benefit, in that humans need to visit a hazardous site only when necessary. From agriculture to mining, many industries are able to gain similar benefits by substituting human operators and aircraft with drone inspections.

However, unlocking deeper cost and productivity benefits from unmanned aerial vehicles (UAVs) will require highly capable drone control systems that are tightly integrated into enterprise workflows.

In this blog we discuss:

- Greater autonomy for future enterprise drones

- What are the key enabling technologies?

- Evolution of a drone technology platform for asset monitoring and surveillance

What will enable greater autonomy for future enterprise drones?

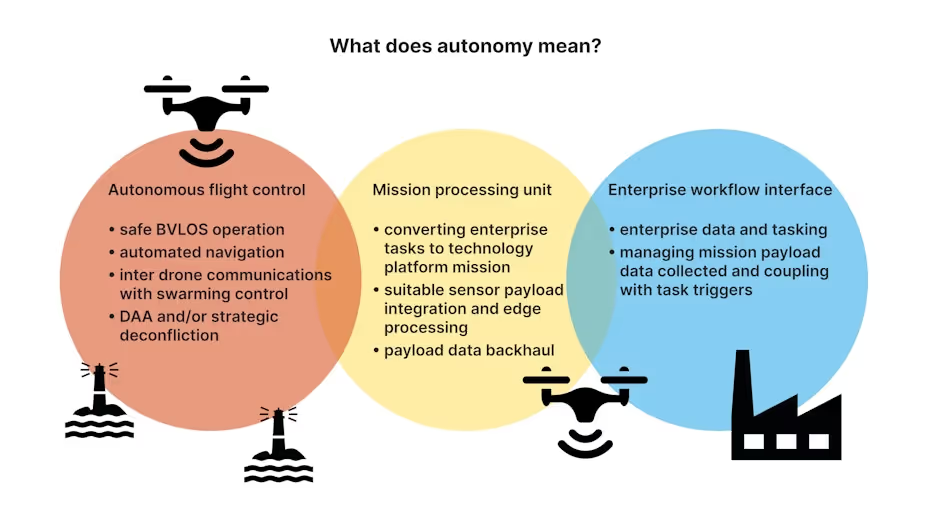

In practice, this means greater drone autonomy, which can be enabled by the interaction and coupling of three components: (a) the enterprise workflow interface, (b) autonomous flight control and (c) a mission processing unit as shown.

Autonomous flight control comprises of safe BVLOS operation, fully automated navigation systems and (in due course) inter-drone communication with swarming control, while mission processing incorporates converting enterprise tasks to a “drone(s) mission”, suitable choice of sensor payload for the mission and the collection, analysis and backhaul of sensor data to the enterprise centre.

At the other end, the enterprise workflow interface communicates “enterprise tasks” to the mission processing unit and subsequently manages the mission payload data being backhauled to the central data centre.

For example, in site safety one can envisage drones that routinely and autonomously monitor an industrial facility, whilst collecting sensor data to identify anomalies, only alerting a human when an intervention decision is required.

Or, in critical infrastructure monitoring, one can foresee clusters of drones flying periodically along pre-planned routes to monitor geographically extended assets using a combination of edge processing and centralised automated compute systems that, in turn, alert operators only if an anomaly is spotted.

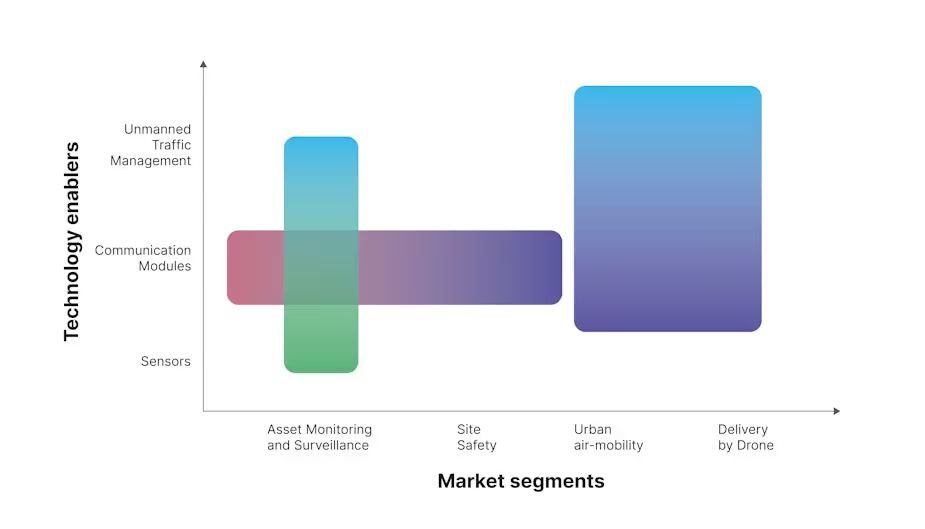

Each market segment has a unique set of technology requirements, which evolve at different speeds. This presents a challenge for product managers seeking to define a roadmap of common underlying technology enablers for their drones.

What are the key enabling technologies?

A superset of drone technology enablers might include:

- Communications modules and networks with sufficient redundancy to support BVLOS drone control and wideband sensor data backhaul

- Hosting framework for all legislated Detect and Avoid protocols; evolving towards fully automated navigation systems to eliminate the drone pilot; perhaps eventually incorporating inter-drone communication with swarming control

- Sensor modules incorporating embedded edge compute for specific applications

Today, drone vendors are struggling to build economies of scale across different verticals, since the presence or absence, relative importance, and specification of each technology enabler can vary enormously, based upon the market segment addressed. Deeper understanding of technology enablers within markets and corresponding market sizes will enable them to identify the potential for common technology platform(s) and sketch out product strategies.

Can we define common technology enablers for future drone products?

In this series of TTP blogs, we consider the evolution of key enabling technologies within some of those segments.

Autonomous asset monitoring and surveillance

In autonomous asset monitoring and surveillance, Detect and Avoid (DAA) will for some time remain on the ‘nice to have’ list, rather than being mandatory. Regulation (and unmanned traffic management systems, in turn) can address the risk of collisions through strategic deconfliction, i.e., the exclusionary assignment of airspace or scheduling of drone operations. And so many market segments, including asset monitoring and surveillance, can be addressed by drones with enhanced BVLOS capability alone.

How will a drone technology platform for asset monitoring evolve?

In future crowded skies, a drone modem that enables safe and autonomous BVLOS operations will need to provide a reliable and low latency command and control link, a fool-proof DAA function, links to enable easy integration with unmanned traffic management systems, and drone ID broadcasting.

It is likely that legislating geographies will draw up different frameworks for DAA and for integration of drone traffic to manned and unmanned traffic management providers. This can already be seen in the varying regulatory pace and varying BVLOS flight maturity amongst European nations for instance.

The move from EASA to harmonize these regulations across EU is encouraging, however the timelines for these are unclear. The UTM scene is likely to be fragmented with several players, each with geographical strongholds. An evolving technology platform will need to be able to support and operate with all of them, whilst maintaining backward compatibility, to support interoperability.

Communications modules and networks – Could 5G be the answer?

The emerging 5G standards are starting to address a drone-assisted future, by stipulating base station antenna patterns optimised towards drone elevations. 5G NR is suitable for use as a command and control link.

However, it is inconceivable that terrestrial networks will provide ubiquitous coverage. Wide-area BVLOS operation may further require a hybrid connectivity platform that combines terrestrial and non-terrestrial connectivity (e.g. satellite or HAPS). Intelligent least-cost data routing could be provided based on data rates, real time/non real time and latency requirements for different classes of user terminal.

With the introduction of 3GPP standards for non-terrestrial networks (NTN), such a hybrid platform could be made fully within the 5G framework. Current timelines for 5G Release 17 and 18 are looking at full-fledged service rollout beyond 2023. Drone vendors may come to benefit from participating inside 3GPP oriented consortia, to ensure that BVLOS and DAA connectivity are well-catered for within 5G NTN use cases. A consortium-based approach built around open 5G standards could be an attractive way to amortize cost.

In the meantime, drone hybrid connectivity platforms will be tied to proprietary satcom services integrated together with conventional cellular connectivity networks. Although this requires considerable custom development effort to realise fully, consortium-based approaches on this basis could still provide a way of amortizing costs and maintaining industry momentum.

In conclusion

A concerted approach by stakeholders in the drone industry to guide the design of a common underlying technology platform would unlock additional industrial productivity assisted by drones.

In our next blog we will consider requirements for other market segments, such as site safety where continuous drone connectivity to a cell tower or NTN cannot be guaranteed. This is a different ballgame altogether, presenting product managers with a new set of challenges.